Are you ready to unlock your potential in the fast-paced world of forex trading? The foreign exchange market holds immense opportunities for those willing to learn, adapt, and apply effective strategies. In our latest blog post, we reveal the secrets to thriving in the forex market, equipping you with insights that can transform your trading approach. Whether you're a beginner or a seasoned trader, understanding the dynamics of forex is crucial for success.

Join us as we delve into expert-led resources designed to elevate your trading experience. This blog post will guide you through key strategies that can enhance your understanding of market trends, risk management, and effective trading techniques. We invite you to embark on a journey toward forex mastery through our comprehensive course, where you’ll discover the tools and knowledge needed to achieve your financial goals in the forex market. Dive in and take the first step toward trading success!

Discover the secrets to thriving in the forex market: Key strategies for success

Thriving in the forex market requires a blend of knowledge, skill, and a solid strategy. Start by understanding the fundamental concepts such as currency pairs, pips, and leverage. Familiarize yourself with various trading styles—scalping, day trading, and swing trading—to find the approach that suits your personality and goals. Developing a robust trading plan that outlines your risk management strategies and entry/exit points can significantly enhance your trading success. By mastering technical and fundamental analysis, you can identify profitable trading opportunities and make informed decisions.

Another key element to thriving in the forex market is emotional discipline. Traders often encounter stress and the temptation to deviate from their established strategies during high-stakes situations. Implementing a disciplined mindset allows you to stick to your plan, conduct thorough analyses, and avoid impulsive decisions. Consider leveraging stop-loss orders to manage risk effectively while cultivating patience and perseverance throughout your trading journey. Consistently applying these strategies will gradually unlock your potential in the dynamic world of forex trading.

Expert-led insights: How our resources can transform your trading approach

Our expert-led course provides you with the essential tools and insights needed to navigate the complexities of the forex market. With a focus on proven strategies and practical techniques, you’ll learn how to analyze market trends and identify profitable opportunities. Our experienced instructors share their personal experiences and trading philosophies, empowering you to develop your own trading style. By engaging in interactive lessons and real-time market simulations, you can enhance your decision-making skills and build a strong foundation for your trading journey.

In addition to the comprehensive course materials, you’ll gain access to exclusive resources, including webinars, trading tools, and a community of like-minded traders. These resources offer continuous support and guidance, helping you stay updated on market fluctuations and emerging trends. Networking with fellow traders creates an environment of shared learning, fostering motivation and collaboration. By actively engaging with our resources, you will cultivate a disciplined trading mindset and unlock the potential for success in your forex journey.

Unlocking your potential: Join our course and start your journey to forex mastery

Embarking on your forex trading journey requires more than just a basic understanding of currency pairs; it demands commitment and the right guidance. By joining our expert-led course, you equip yourself with invaluable tools and strategies designed to enhance your trading skills. Our comprehensive curriculum covers essential concepts, from risk management to technical analysis, ensuring a well-rounded education. Engaging with our experienced instructors provides real-time insights and personalized feedback, transforming your approach to the ever-changing forex market.

Taking the step to invest in your education today unlocks your potential tomorrow. The forex market can appear intimidating, but with the right mentorship and resources, you can navigate it with confidence. Our course not only prepares you for the challenges ahead but also connects you with a community of like-minded traders. Share experiences, gain new perspectives, and support each other on the path to success. Join us and set yourself on a course toward forex mastery that can change your financial future.

In the world of trading, countless individuals focus on refining their strategies, believing that the key to success lies in advanced indicators and technical analysis. However, what many fail to realize is that the true cornerstone of profitable trading lies in mastering one’s mindset. Embracing emotional discipline, patience, and self-awareness can significantly shape long-term success in the market. Through my personal journey—from facing the disappointment of blown accounts to cultivating a resilient mental approach—I’ve come to understand that a trader's mental game often outweighs any strategy they employ.

This blog post delves into the psychology behind successful trading, emphasizing why mindset is paramount. We will explore the common emotional traps—such as fear, greed, and revenge trading—that can undermine even the most skilled traders. Additionally, I’ll share practical tips for developing a robust trading mindset, along with a daily checklist to help you stay grounded. By reflecting on the emotions that drive your decisions, you can pave the way to becoming a more disciplined and profitable trader.

Why mindset trumps strategy: The foundation of successful trading

In the world of trading, many individuals fixate on developing the perfect strategy. They meticulously analyze charts, backtest algorithms, and obsess over indicators, believing that a robust trading plan will dictate their success. However, research and real-world experiences reveal that it is often the trader’s mindset that ultimately determines profitability. Emotional discipline, patience, and self-awareness position traders to adapt and thrive, even in volatile markets. A strong mental foundation enables you to stick to your strategy during tough times, adjust your approach without becoming reactive, and remain focused on your long-term objectives.

When you prioritize mindset over strategy, you create an environment where learning and growth can flourish. Developing a healthy trading psychology empowers you to manage risks more effectively, maintain objectivity during trades, and cultivate resilience in the face of setbacks. This mindset shift allows you to view losses as opportunities for improvement rather than signals of failure. By focusing on nurturing your mental game, you can unlock a level of trading performance that even the best strategies cannot achieve alone, ultimately leading to sustained success in the trading arena.

Recognizing and overcoming emotional pitfalls: Fear, greed, and revenge

Every trader faces emotional pitfalls that can derail their success, but recognizing these traps is the first step toward overcoming them. Fear often paralyzes traders at critical moments, leading to missed opportunities or premature exits. This anxiety can result from uncertainty about market movements or fear of losing hard-earned capital. Greed, on the other hand, can create a dangerous mindset where traders chase profits without a well-defined plan, often resulting in over-leveraging and catastrophic losses. The intensity of these emotions can cloud judgment, pushing traders to make impulsive decisions that contradict their strategies, further exacerbating their challenges.

Revenge trading represents yet another emotional trap that can cripple even the most skilled traders. After experiencing a loss, it’s easy to fall into the mindset of getting back what I lost, which can lead to reckless trading behavior. This cycle of retaliation against the market dilutes the importance of disciplined, strategic thinking, as traders prioritize regaining losses over making reasoned decisions. Successfully navigating these emotional pitfalls requires self-awareness and emotional discipline. By acknowledging these emotions and establishing a mental framework to manage them, traders can transform their approach, turning potential setbacks into opportunities for growth and learning.

Transformative moments in your trading journey: Building resilient mental habits

Every trader has a pivotal moment that forces them to reassess their approach to the markets. For me, it came after a series of devastating losses that wiped out my early trading accounts. I realized that no matter how sophisticated my strategies were, they couldn’t compensate for my lack of emotional control. This turning point sparked a commitment to delve deep into the psychology of trading. I began to study my emotions, recognizing that fear and greed often led to impulsive decisions. This self-awareness became the cornerstone of my trading journey, helping me establish more disciplined habits that prioritized long-term growth over short-term gains.

As I transformed my mindset, I sought out reliable practices to reinforce my emotional resilience. I developed daily rituals, such as mindfulness meditation and journaling, to maintain mental clarity and focus. These habits allowed me to reflect on my trades objectively, rather than through the lens of my emotions. By consistently revisiting my goals and values, I minimized the impact of emotional traps and made more deliberate decisions. Embracing this holistic view of trading not only improved my performance but also fostered a sense of fulfillment, proving that a resilient mindset is truly a trader's greatest asset.

In the dynamic world of trading, understanding how institutional players operate can set you apart from the crowd. Smart Money Concepts (SMC) empower retail traders to align their strategies with the logic of market makers, enabling them to navigate the complexities of the financial markets more effectively. By employing the ICT (Inner Circle Trader) strategy, traders can learn to identify critical price movements and patterns that signal potential market shifts. This blog post delves into the essence of Smart Money Concepts, unraveling the intricacies of trading like institutions and revealing the tools necessary for success.

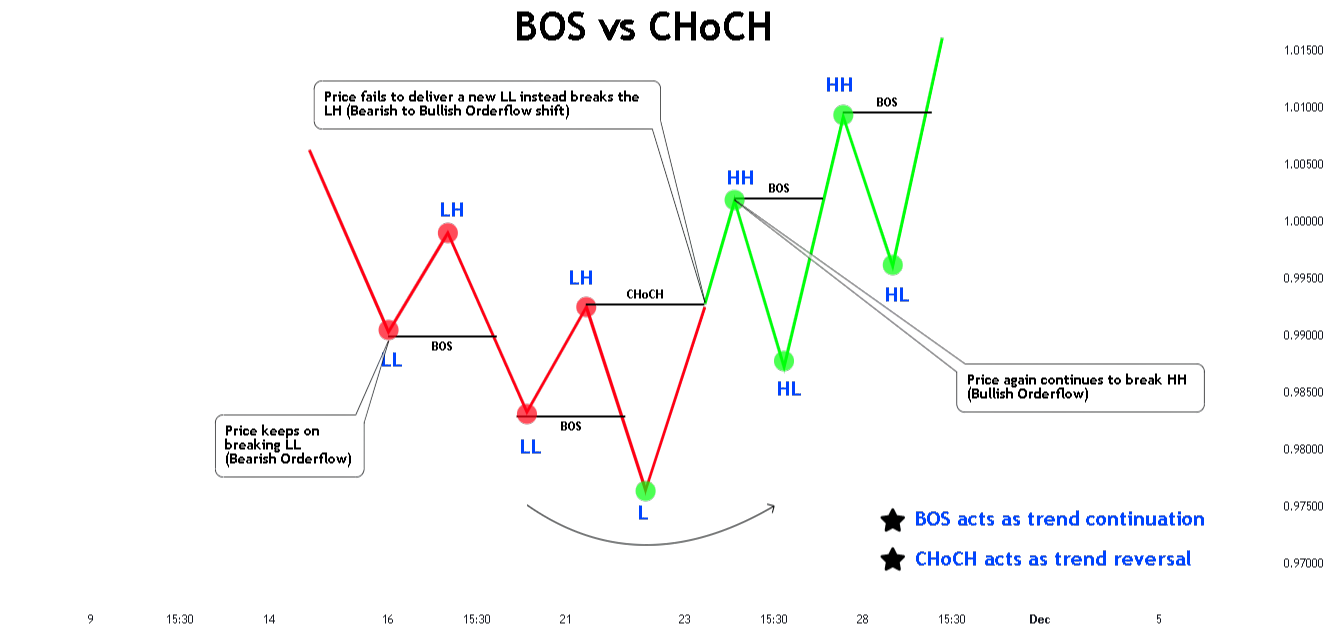

As we explore this topic, we'll break down key elements such as Break of Structure (BOS), Change of Character (CHoCH), and essential liquidity zones. Understanding these concepts not only enhances your trading knowledge but also equips you to recognize the footprints left by institutions in the market. Whether you're a novice or an experienced trader, mastering these strategies can significantly improve your approach to trading. Join us as we unpack the Smart Money Concepts and the ICT strategy, helping you transform your trading style and make informed decisions that align with the actions of the financial giants.

Understanding smart money concepts and their importance in trading

Smart Money Concepts (SMC) represent a shift in how traders perceive market movements and price actions. Traditional trading approaches often rely on technical indicators and historical patterns, but SMC encourages traders to align their strategies with the logic of institutional investors. Understanding this framework allows retail traders to recognize when an institution is likely to enter or exit the market, providing a competitive edge. By focusing on the behaviors of market makers, traders can better predict price movements and identify potential trading opportunities.

The significance of Smart Money Concepts lies in their ability to illuminate the often-hidden dynamics of the financial markets. By studying the footprints left by institutions, traders can decode specific signals that represent a forthcoming shift in price direction. Concepts like liquidity grabs and Break of Structure (BOS) serve as indicators that reveal when big players are manipulating price to their advantage. This insight empowers traders to make informed decisions, minimizing risks while maximizing profit potential by trading alongside the institutions rather than against them.

Unraveling key strategies: BOS, CHoCH, and liquidity zones

Break of Structure (BOS) is a fundamental concept in Smart Money Concepts that helps traders identify potential reversals and trend continuations. When price breaks through a significant support or resistance level, it signals a shift in market sentiment. Recognizing these breaks allows traders to align their positions with institutional movements, increasing the likelihood of capturing profitable trades. By understanding when a BOS occurs, traders can position themselves advantageously before the crowd follows the trend, capitalizing on price movements that align with institutional strategies.

Similarly, the Change of Character (CHoCH) indicates a potential shift in the market's structure, helping traders identify turning points. When price enters a new trading range after rejecting previous support or resistance, it signals a CHoCH. This concept is crucial in understanding shifts in market dynamics, as it reveals when traders might transition from bullish to bearish sentiments and vice versa. Additionally, liquidity zones play a vital role in trading strategies, as they represent areas where price tends to gravitate due to the presence of buy or sell orders. By analyzing these liquidity zones, traders can enter trades that align with the movements of institutional players, allowing them to trade like the pros.

Mastering the ICT strategy for institutional trading success

The ICT (Inner Circle Trader) strategy serves as a crucial framework for traders aspiring to think and act like institutional players. By focusing on market structure, the ICT strategy helps traders identify key areas where institutions are likely to enter or exit positions. This method encourages practitioners to look for optimal trade entries based on market behavior rather than relying solely on traditional indicators. Understanding the intricacies of price movements allows traders to pinpoint their entries at premium and discount levels, increasing the potential for higher reward-to-risk ratios.

Moreover, implementing techniques such as Order Blocks and Fair Value Gaps enhances one’s ability to navigate market fluctuations effectively. Order Blocks represent price levels where significant buying or selling occurred, indicating potential reversal zones. Meanwhile, Fair Value Gaps highlight areas in the market where prices have not had sufficient time to consolidate, providing opportunities to enter after a liquidity grab. By mastering the ICT strategy, traders can better align their actions with institutional flows, enabling them to make informed decisions that capitalize on market dynamics. Ultimately, this mastery transforms retail traders into savvy market participants who harness the principles of Smart Money Concepts for sustained trading success.